UAE’s Ziina Scores $850,000 Investment to Launch First Fully-Licensed P2P Payment App

The Dubai-based FinTech startup has raised an impressive pre-seed round, led by San Francisco’s Class 5 Global.

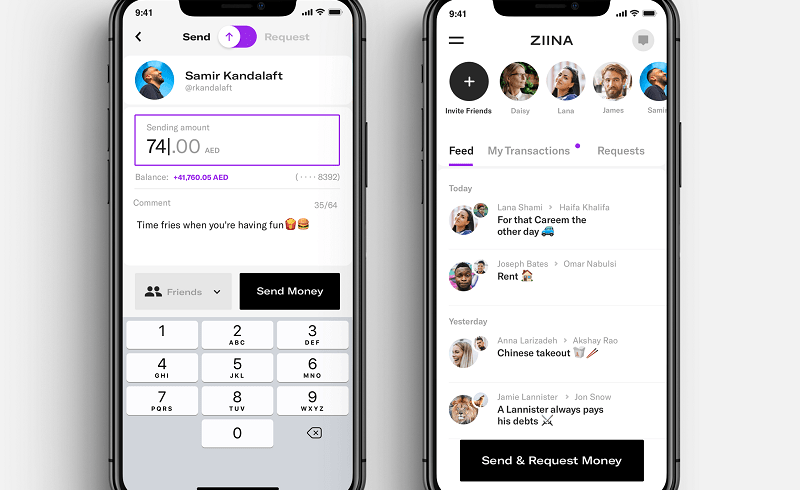

The UAE’s first official P2P payment application (think Venmo) Ziina has just been released, after the Dubai-based startup secured a pre-seed investment of $850,000 to bring their product to market. The investment was led by San Francisco’s Class 5 Global and saw participation from Jabbar Internet Group and other angel investors.

The app is the first-of-its-kind in the UAE, and allows users to transfer money to anyone in their contacts, without IBAN or Swift Codes; the user’s unique ID is instead their phone number, making sending money as easy as sending a text message. When signing up, users just add their bank account details to their profile and they’re ready to send or receive money immediately. Uniquely, Ziina does not charge users for neither sending nor receiving funds, but they do note that the UAE Central Bank will apply a AED 1 fee for every transaction.

“With several user-centric features, Ziina will redefine the way people in the Middle East think of, interact with and experience financial services. Our company is founded on the belief that everyone should have access to the next generation of financial services,” says Faisal Toukan, CEO and Co-founder.

The Ziina team have also announced that they'll also be rolling out QR code integration which means you’ll eventually be able to use your phone like a credit card, by scanning the QR code at retailers. They’ll also be adding utility payment services and pre-paid recharge cards for those without bank accounts to still take advantage of the P2P system they’ve put in place.

“We want to democratise access to financial services by placing one platform in the hands of every individual. For example, we want to make it possible for anyone who wishes to invest to do so easily by integrating 3rd party robo-advisors to Ziina’s platform. We will prioritise use-cases based on customers’ largest pain points and add them product by product,” adds Sarah Toukan, Co-founder and Chief Product Officer at Ziina.