UAE Blockchain Fintech Pyypl Raises $11M for GCC & Africa Expansion

Looking to tackle financial inclusion in the Middle East and Africa, Pyypl’s latest investment builds on its global acclaim.

The MENA region’s fastest-growing fintech Pyypl - pronounced ‘People’ - has just closed an $11 million Series A round, with several undisclosed global investors from Europe, North America, Asia, and the Middle Eastern. This new influx of funding tailgates previous investment funds by international venture capitalists and firms alike.

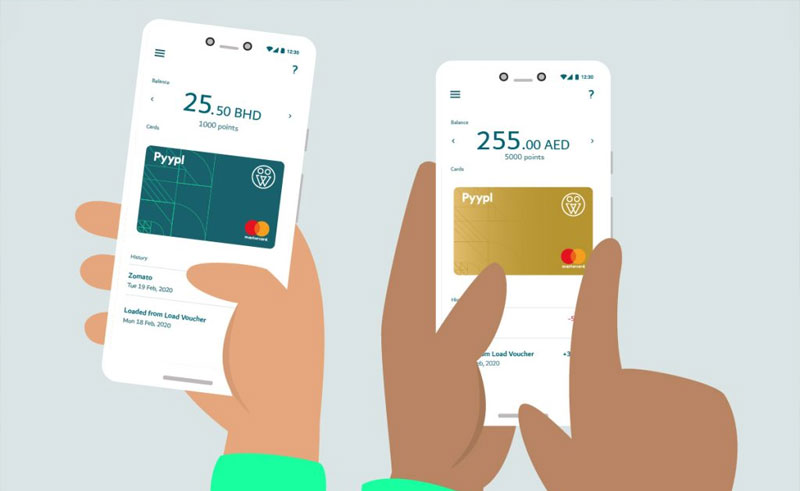

Pyypl denounces the mechanical act of credit and debit payments, opting instead for digitalised payment and financial transactions with an all-familiar user interface. Stationed in the UAE, the globally-acclaimed fintech labeled ‘2021’s Global Visionary’ by Ripple, has recently been dubbed the first-ever predominantly Middle Eastern enterprise to set up a ‘Blockchain On-Demand Liquidity’ remedying the tediousness of international bank transfers. 2021 also saw promising endeavors from Pyypl, with its newfound synergy with Visa, bolstering their innately outstanding market presence within the fintech sector. For CEO and founder, Antti Arponen, now is the time to tackle financial inclusion across the Middle East and beyond.

“Whilst having a mobile phone and internet connection, are either completely unbanked or severely under-served in their daily financial services,” he said, adding that the funds will be deployed to scale operations in the GCC and Africa, with Kenya and Mozambique top of the list of priorities.

- Previous Article Egypt’s Takery Cloud Hubs Raises $3 Million Seed Round

- Next Article US-Based Egyptian Fintech MoneyHash Raises $3 Million Pre-Seed