Fintech Startup Flexxpay Raises $3 Million to Expand its Financial Wellness Services Across MENA

Led by JIMCO and Target Global with participation from seven other investors, the financial wellness platform will use its Pre-Series A round to grow its corporate client base across MENA.

Already boasting regional reach from operations out of KSA and UAE, fintech trailblazer, Flexxpay, is looking to grow its corporate client base across MENA and expands its tech platform, after raising $3 million is Pre-Series A funding. Arriving as a mixture of equity and venture debt, the round was led by JIMCO and Target Global, with participation from a whole host of investors, including Wamda, DIFC FinTech Fund, March Holding, Arzan VC, Sukna Ventures, Nuwa Capital and VentureSouq.

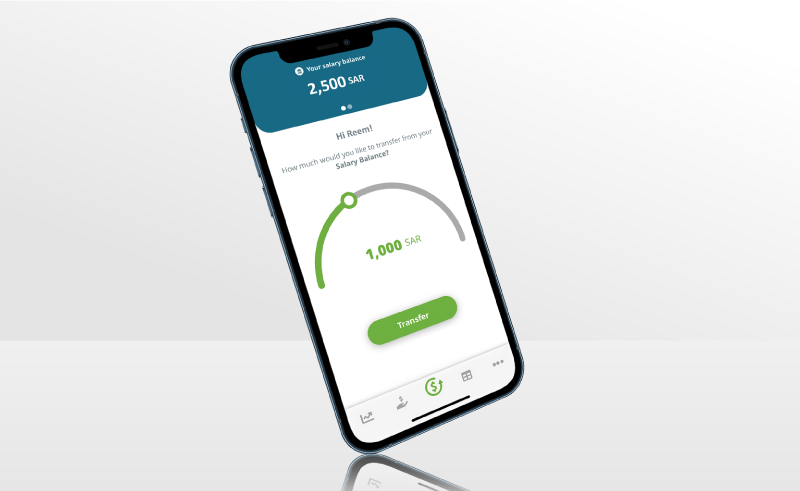

Launched in 2018 by Michael Trüschle and Charbel Nasr, the ‘financial wellness platform’ aims to provide an alternative to the traditional corporate payment cycle, allowing employers to offer their employees salaries and commissions in advance. This sense of flexibility and the ease of doing it all through an app is made all the more unique by the fact that it charges small transaction feeds, rather than interest. News of expansion for Flexxpay should come as no surprise. The Dubai-based startup signalled its intent in January, 2021, when it announced the launch of a new telesales and innovation centre in Lebanon. Seen as an important move for strategic growth, the centre adds to on-ground sales forces in UAE, KSA and Bahrain. Like only the most impactful innovators in the fintech sectors, the co-founding duo look beyond the tech and see Flexxpay as tackling a much more intangible issue.

News of expansion for Flexxpay should come as no surprise. The Dubai-based startup signalled its intent in January, 2021, when it announced the launch of a new telesales and innovation centre in Lebanon. Seen as an important move for strategic growth, the centre adds to on-ground sales forces in UAE, KSA and Bahrain. Like only the most impactful innovators in the fintech sectors, the co-founding duo look beyond the tech and see Flexxpay as tackling a much more intangible issue.

“We are solving a real-world problem for employers and their employees,” said Trüschle, who also serves as the CEO of Flexxpay. “Financial stress directly impacts the bottom line of a company’s P&L and is one of the main factors for employees being less productive and reporting sick. Giving people access to what they have already earned is just the right thing to do. They’ve earned it, they deserve it.”

This mindset has put Trüschler and Nasr in good stead, with Flexxpay's eclectic roster of clientele covering a range of sectors, including insurance, telecoms, retail, logistics, financial services and real estate. With the likes of PayActiv and Dailypay gaining more and more traction in the US with similar models and services, and the likes of Wagestream and Hastee doing likewise in the UK, there’s no reason Flexxpay can’t eventually look beyond the borders of the MENA region for its next move.

Learn more about Flexxpay here.