Egypt’s 10 Most Explosive Startup Deals of 2025

From proptech, fintech, and edtech, these are the companies behind the 10 largest funding rounds in Egypt this year.

In 2025, Egypt’s startup ecosystem demonstrated a clear resurgence, attracting over $220 million in disclosed equity and debt funding despite broader regional volatility. Investors showed renewed confidence in the market, backing companies that are reshaping core sectors such as proptech, fintech, edtech, and digital financial services. From record-breaking real-estate platforms to fast-growing consumer finance players, here are the startups behind the 10 largest funding rounds in Egypt this year.

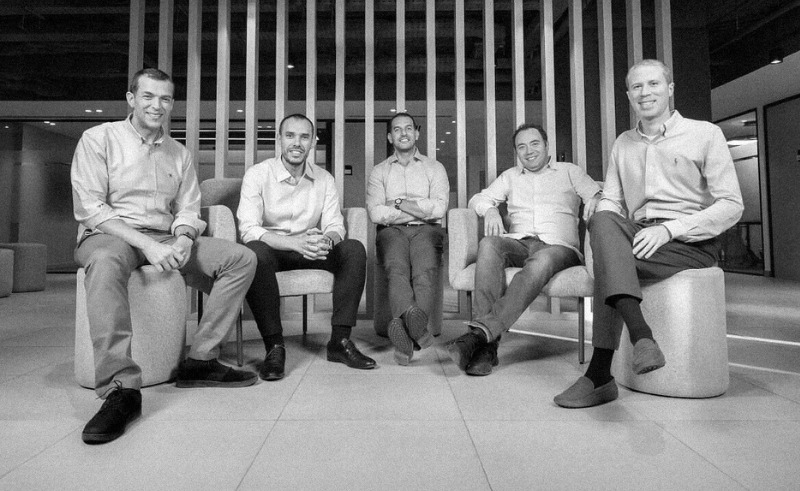

Nawy ($75 million)

Egyptian proptech startup Nawy secured one of the country’s largest funding rounds in 2025. In May, the company raised $52 million in Series A equity led by Partech, with participation from e& Capital and Shorooq Partners. Nawy also obtained an additional $23 million in debt financing dedicated to expanding its mortgage offering. Founded in 2019 by Mostafa El-Beltagy, Abdel-Azim Osman, Ahmed Rafea, Aly Rafea, and Mohamed Abou Ghanima, the company has grown into Africa’s largest real estate technology platform, supporting property financing, management, and investment across the Egyptian market.

Tasaheel-MNT-Halan Group ($50 million)

Tasaheel, the lending arm of Egypt’s MNT-Halan Group, founded by Mounir Nakhla and Ahmed Mohsen, completed one of the country’s largest capital raises in 2025. The company issued $50 million in corporate bonds, in May, subscribed by a group of local institutional investors. The proceeds are allocated to expanding Tasaheel’s microfinance and digital lending activities across Egypt. Established as part of MNT-Halan’s wider financial services ecosystem, Tasaheel provides credit products to individuals and small businesses, supporting the group’s broader push to scale financial inclusion and digital credit infrastructure nationwide.

Valu ($27 million)

Valu raised $27 million in equity financing in May to support its expansion and product development. Founded by Walid Hassouna, the company, legally registered as U Consumer Finance S.A.E., has grown into one of Egypt’s leading fintech platforms, offering Buy-Now-Pay-Later services, consumer finance products, and digital payment solutions. In early 2025, Valu reported more than 9.2 million processed transactions and maintained roughly a 25% share of Egypt’s consumer-finance market. The newly secured capital will be used to scale its financial products, expand its merchant network, and strengthen its digital services across the country.

Khazna ($16 million)

In February, Egyptian fintech Khazna completed a Pre-Series B funding round of $16 million, enabling the company to scale its suite of digital financial services across Egypt. The startup, founded by Omar Saleh, Ahmed Wagueeh, Fatimah El Shenawy and Omar Salah, focuses on providing salary advances, bill payments, and micro-savings solutions to underserved and low-to-middle-income users. With this injection of capital, Khazna aims to expand its partnerships with employers, merchants, and financial institutions, supporting broader adoption of its platform nationwide.

Sylndr ($15.7 million)

Sylndr, an Egyptian auto-tech startup, secured $15.7 million in Series A funding in May, led by Nuwa Capital with participation from Algebra Ventures and other regional investors. Founded in 2021 by Omar El Defrawy, the company operates a digital platform for buying, selling, and financing pre-owned vehicles. The funding supports the expansion of Sylndr’s product offering, continued investment in its technology and operations, and broader engagement with dealers and customers across Egypt.

Thndr ($15.7 million)

Thndr closed a $15.7 million funding round in May as it continued to scale its retail-focused investment platform. Founded in 2020 by Ahmad Hammouda and Seif Amr, the company offers access to stocks, mutual funds, and savings products through a mobile-first experience. The round was led by global technology investor Prosus, with participation from Y Combinator, BECO Capital, Endeavor Catalyst, JIMCO, Raba, and Onsi Sawiris, and will support further platform development and broader access to investment services in Egypt.

Money Fellows ($13 million)

Money Fellows completed a $13 million Pre-Series C round in May. Founded in 2017 by Ahmed Wadi, the Egyptian fintech runs a mobile platform that digitises rotating savings and credit associations (ROSCAs), allowing users to save collectively and access credit digitally. The round was co-led by Al Mada Ventures and DPI Venture Capital and will be used to broaden the company’s product capabilities and extend its presence across Egypt and additional markets.

Sprints.ai ($10 million)

Founded in 2020 by Ayman Bazaraa and Bassam Sharkawy, Egypt-based edtech startup Sprints.ai raised a $3 million bridge round led by Disruptech Ventures, with participation from EdVentures and CFYE. The company focuses on delivering intensive, job-aligned training programmes aimed at upskilling digital and technical talent, working closely with employers to address market-ready skills gaps.

Rology ($10 million)

Egypt-based healthtech startup Rology completed a growth funding round with participation from Philips Foundation, Johnson & Johnson Impact Ventures, Sanofi Global Health Unit’s Impact Fund, and MIT Solve Innovation Future. Founded in 2017 by Amr Abodraiaa, Moaaz Hossam, Mahmoud Eldefrawy, and Bassam Khallaf, the company operates a teleradiology platform that connects healthcare providers with distributed radiology specialists to support faster and more accessible diagnostic services.

Octane ($5.2 million)

In a $5.2 million funding round led by Shorooq, Cairo-based fintech startup Octane is scaling its platform for digitising fleet and fuel payments across the MENA region. Founded in 2022 by Amr Gamal and Ziad Eladawy, the company provides digital tools that help businesses manage fuel and fleet-related spending more efficiently. The funding will support product development, regional expansion, and partnerships with fuel providers and fleet operators, aiming to streamline operations and reduce costs for corporate clients.