Sudanese Fintech Bloom Raises $6.5 Million Seed Round

Founded in 2021 by Ahmed Ismail, Youcef Oudjidane, Khalid Keenan and Abdigani Diriye, Bloom helps mitigate the effects of inflation for Sudanese individuals.

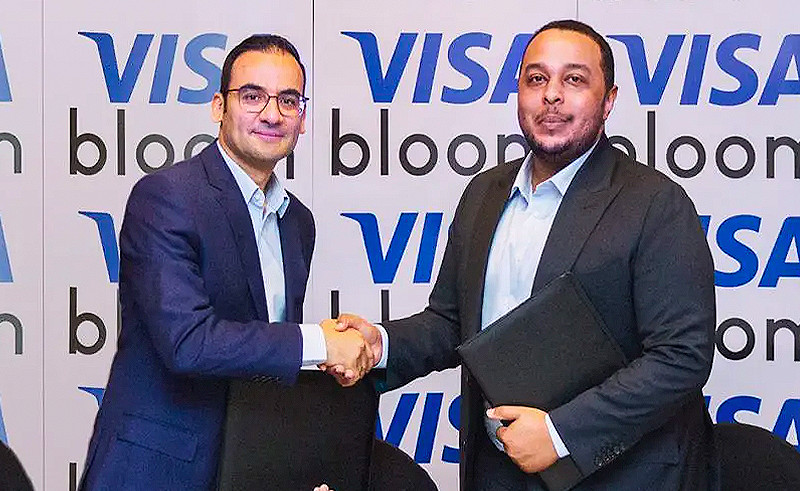

Bloom, a Sudan-based fintech startup, has raised a $6.5 million Seed round backed by Visa, Y Combinator, Global Founders Capital (GFC), Goodwater Capital, and UAE-based early- stage firm Venture Souq, among other angel investors.

Founded in 2021 by Ahmed Ismail, Youcef Oudjidane, Khalid Keenan and Abdigani Diriye, Bloom helps mitigate the effects of inflation for Sudanese individuals. It offers accounts for users to save in U.S. dollars and buy and spend in Sudanese pounds.

The platform also includes a feature where users can receive remittances from abroad free of charge. The startup works with the Export Development Bank, a partner bank that handles deposits, and makes revenue from interest on these deposits - the interchange - in addition to other revenue streams. According to Bloom’s founders, this seed round will help the Sudanese startup expand across the Anglo-East African region, and reach countries such as Ethiopia, Kenya, Rwanda, Tanzania and Zambia.

Fintech startups in Africa have been receiving significant investments over the past year. In 2021, Africa-based fintech startups have attracted over $1 billion in investments, the highest funding ever reached since 2015, according to Statista. Some notable investments in African fintechs include South Africa’s TymeBank raising $180 million in 2021, Nigeria’s Flutterwave raising $170 million also in 2021, and Ghanian-based Dash, raising $32.8 million in 2022.