UAE’s ‘Shop Now Pay Later’ Platform Raises $23 million in One of MENA’s Biggest Ever Series A Rounds

With COVID-19 forcing many retailers online, Tabby has been able to ease decreased availability of consumer credit.

The rise of shop now pay later platforms has increased over the past few years across MENA, with the pandemic further accelerating demand. Considered the first and biggest fintech of its kind, UAE-born Tabby, has raised what many have touted as one of the biggest Series A funding rounds in the region - an investment of $23 million.

Coming off the back of a $7 million fundraise almost six months ago, this time the investment was led by VC Arbor Ventures, a Southeast Asian VC firm, and prolific UAE firm, Mubadala Capital.

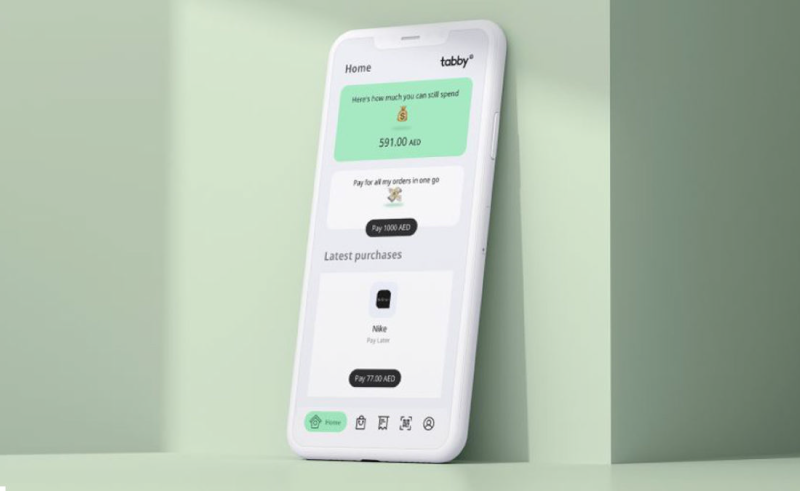

Tabby has two offers for customers, with neither costing anything. They are able to defer payment of their purchase for up to 30 days or spilt their payment into four equal monthly installments. Tabby also seamlessly integrates both into online checkouts and in-store POS systems. They charge the merchants a commission for all the sales that are generated through its platform, which they claim helps increase both conversion rates by 20% and transaction sizes by 30% to 85%.

In just a year, Tabby has been partnered with over 500 merchants, including global and regional brands such as Toys R Us, Al Futtaim Group and many others. While there are many other ‘shop now pay later’ platforms in the region, including Spotii, Postpay and ValU, Tabby is the best-funded in the region, operating in UAE and Saudi Arabia.

In addition to the aforementioned $7 million investment, 2020 has also seen Tabby partner with Visa, as well as join the Saudi Arabian Central Bank’s regulatory sandbox.