Cairo-Based Fintech Trevi Launches App to Simplify Finances

Trevi plans to expand beyond Egypt to bring these services to new markets across the EMEA region.

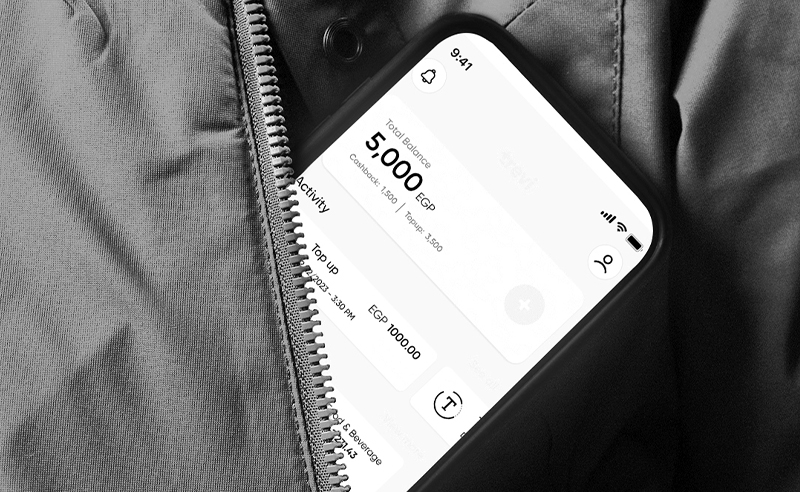

Cairo-based fintech startup Trevi has launched a mobile app that offers seamless payment options with several top-up methods. Amongst the key features included on the app are smooth payment processing, rewards, cashback programs, family wallet and personalised insights based on users’ spending habits.

Users can easily top up their wallets using debit or credit cards, as well as Apple Pay and ValU, and can make payments by simply scanning a QR code, with NFC payment options coming soon. Along with cashback and loyalty benefits, users can expect to earn rewards with every purchase at a variety of partner merchants like Baky Hospitality, covering sectors such as fine dining, jewellery, fashion, electronics and grocery stores.

Users can also expect immediate benefits on every transaction, with extended cashback validity for up to three years with no cap

The ‘Family Wallet’ feature centralises household financial management, allowing users to set limits, monitor spending, and distribute cashback benefits, creating a practical and rewarding solution for shared finances.

The travel feature includes streamlined bookings for flights, hotels and accommodations. Users will be able to enjoy a cashback on their net purchase amount.

Under CEO Antony Sobhy’s leadership, Trevi plans to expand beyond Egypt to bring these services to new markets, including Jordan, Saudi Arabia, UAE, Lebanon, Morocco, Libya, Iraq, and other countries in the EMEA region over the next five years.

“Trevi is dedicated to transforming the way consumers handle their finances by offering a wide array of competitive services. Our goal is to provide users with exceptional experience while ensuring the utmost security for their financial transactions and management,” Sobhy tells StartupScene.

Trevi plans to introduce more features in the future, including a budgeting feature that will allow users to input their income level and set goals for them to save more. Their upcoming ‘Trevi Lifestyle’ service will offer exclusive access to events, concierge support, and tailored activities to simplify and enrich daily life. Their planned ‘Trevi Spaces’ service will help manage shared expenses. ‘Save Now Pay Later’, meanwhile, will enable users to avoid price surges, and access tailored lending and leasing options. Trevi also pledges to donate 1% of its revenue to charitable organisations.

For further details, you can visit Trevi’s website or join the community by downloading the app.

- Previous Article Palm Ventures Launches $30 Million Fund for Startups in AI Sectors

- Next Article Global Streaming Platform Myco Expands Into Egypt