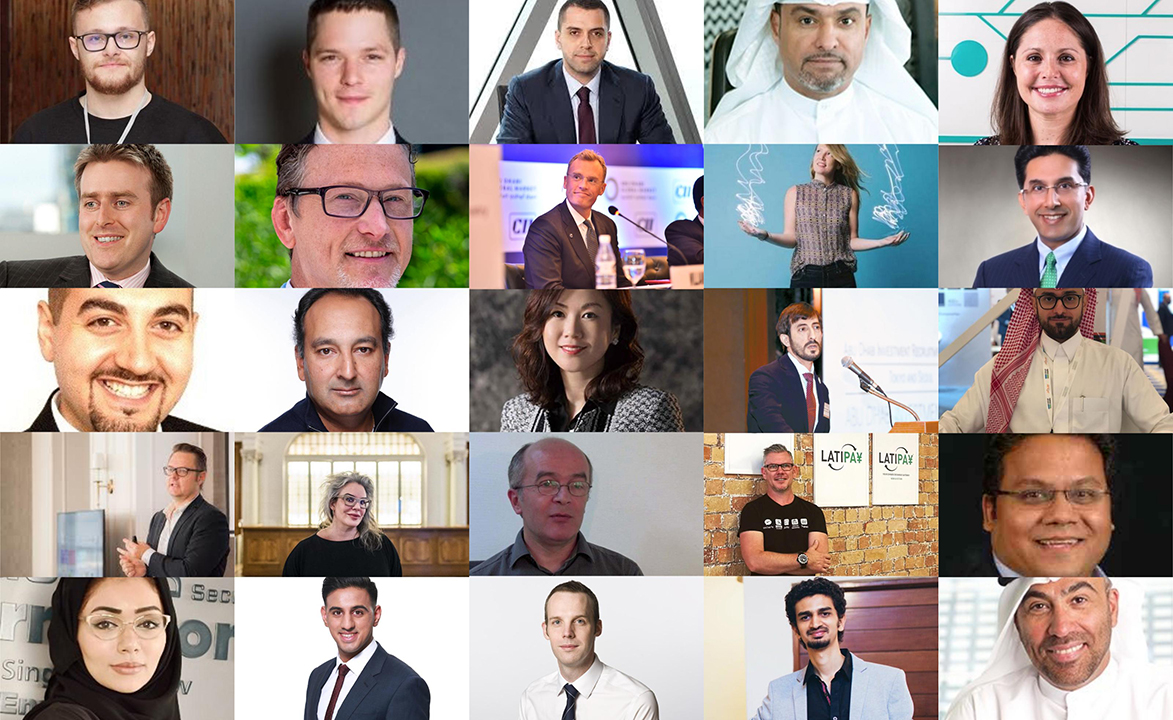

Here Are The 38 Speakers You'll Meet At Fintech Abu Dhabi's Second Edition

On September 17th, at the Fairmont Bab Al Bahr, Fintech Abu Dhabi's bringing together a bouquet of experts from all over the world to speak at its second edition.

At Bab Al Bahr's Fairmont, Fintech Abu Dhabi's second edition is gathering speakers from the farthest east with ones from the farthest west, on September 17th. The organisers are getting ready to bring all 38 experts together to discuss industry matters that affect the development of the financial services at the two-day summit, put together by Abu Dhabi Global Market (ADGM) and held under the patronage of Sheikh Hazza bin Zayed Al Nahyan, Vice Chairman of the Abu Dhabi Executive Council.

“The close collaboration between regulator, corporates and FinTech start-ups is the hallmark of a sustainable and effective approach to embracing innovation in the financial sector," says Wai Lum Kwok, Executive Director of the Capital Markets at Financial Services Regulatory Authority of ADGM. "Abu Dhabi Commercial Bank (ADCB) has been an active champion and partner of ADGM in steering the innovation agenda. This year’s Innovation Challenge is about promoting real adoption and business use cases of innovation, and we are excited to be working with ADCB to road-test a new solution which can be applied and adopted across the banking ecosystem.”

Abdullah Al Darmaki, CEO of Khalifa Fund

Al Darmaki is the chief executive of the Khalifa Fund for Enterprise Development (Khalifa Fund) a government-owned vehicle that drives the development of SMEs in the UAE. His vision and strategic objectives have further cemented Khalifa Fund as part of the Abu Dhabi Economic Vision 2030 to drive and cater for a versatile base of investments, which also is synonymous with the bigger UAE Vision 2021.

He attributes his lean style of management to the experience he has managed to attain over the last 20 years, starting in the Hydrocarbon spectrum back in 1994, then Capital Investments as well as Manufacturing Industry and most recently within the Civil Service domain.

The CEO was one of the first to be selected from the Oil and Gas sector to be working within the (back then newly established) Petrochemical Industry. That would then give him the opportunity to be stationed within South East Asia and gain experience on how this new industry coming from the Middle East is able to penetrate the Asian Markets. Upon his return, he ventured into capital investments in Dubai at a time when the Global Financial markets were heavily invested in the region and being part of the Dubai Holding gave him the ability to work with leading investment institutions who look at the UAE as an attractive investment. In the late 2000’s, Al Darmaki was headhunted to join the Abu Dhabi Civil Service as the local government was looking to rebuff its senior civil service pool.

He was assigned to head the National Employment Agency (the Abu Dhabi Tatween Council) a domain outside his comfort zone, but nonetheless a challenge to which he was able to rise up to the occasion. Transforming the role of the Abu Dhabi Tawteen Council is possibly considered to be one of his major milestones that he was able to deliver, especially when there were multiple stakeholders involved and required the buy in from Civil Society to understand their ability to become employable and apprehend the chance to further develop their skills to enter the employment market.

Ahmad Bin Ghannam, ADIO

Ghannam has been the CEO of the Abu Dhabi Investment Office (ADIO) since its launch under the emirate’s Department of Economic Development (ADDED) in February 2018. ADIO promotes investment opportunities within Abu Dhabi, facilitates foreign direct investments in targeted sectors and industries, and provides a platform to for stakeholders to enhance networks and partnerships that support private sector growth. ADIO supports new and existing investors to ensure that the experience of doing business in Abu Dhabi is efficient and effective. His focus is to build technical and operational team capabilities to enhance domestic and international partners’ roles in supporting the emirate’s economic diversification and growth programme.

The CEO also has responsibilities for ADDED’s Planning and Statistics functions, and for overseeing the development of the emirate’s economic policies and plans. In these capacities, he provides advice on economic issues to stakeholders in Abu Dhabi’s government.

A member of ADDED’s team since 2015, Ghannam previously managed the General Secretariat of Executive Council’s Economic Affairs Department and was Acting Secretary for the Executive Council’s Economic Development Committee. He has over 15 years senior executive experience, with prior contributions to Tawazun (Deputy Executive Director of Operation Support), Etisalat (Director of ICT Solutions and EGovernment Program Manager), and UAE Federal Government’s Civil Service Council.

Ahmed Ali Al Sayegh, Chairman of Abu Dhabi Global Market

Ahmed Ali Al Sayegh, Chairman of ADGM – the International Financial Centre in Abu Dhabi, has a wealth of local and global experience that spans over three decades. He holds several positions in a number of leading public and private institutions in Abu Dhabi, and has extensive track record in launching and developing pioneering initiatives across various key industries.

In addition to his current office, Mr Al Sayegh is the Managing Director of Dolphin Energy Limited, Vice-Chairman of the Emirates Wildlife Society, and Board Member of Etihad Airways Group.

In his career, Mr Al Sayegh was in several senior positions including being former Chairman of Aldar Properties and Chairman of Abu Dhabi Future Energy Company (Masdar). Mr Al Sayegh also held executive positions in several leading governmental institutions such as Abu Dhabi National Oil Company (ADNOC), and Abu Dhabi Investment Company (Invest AD).

Alexander Al Basosi, IBM Cloud Garage

Alexander Al Basosi is a Blockchain Developer with the IBM Cloud Garage in Dubai. He first heard of Blockchain in 2017, and since then has worked on a variety of projects making use of the Linux’s Foundation’s Hyperledger Fabric, a consortium-based open source project aimed at creating a standard for Business-centric Blockchain applications. Having received his Bachelor’s Degree in Computer Science from the University of Wollongong in Dubai, he started working in IBM in 2017 as a Cloud Developer Experience Intern. He is quite familiar with the startup ecosystem in the UAE, and has delivered many workshops and supported many hackathons throughout the duration of his internship. At the present time, Alexander is working as a Blockchain Developer in the IBM Cloud Garage in Dubai, which is imbued with a startup DNA to help enterprises innovate faster and respond to shifts in the market.

Amit Goel, founder of MEDICI

Amit Goel is the Founder & Chief Strategy & Innovation Officer for MEDICI. Amit’s vision is to build a strong FinTech market network that involves financial institutions, banks, startups, investors, analysts & other key stakeholders across the ecosystem – helping each one of them in a meaningful way by removing the symmetry of information and providing a platform to engage & transact.

Amit is passionate about bringing actionable FinTech-focused insights, innovative products & services for the FinTech ecosystem. Some of his work involves startup scores, bank scores/assessments, predictive viewpoints & other innovations that have helped MEDICI’s customers and the ecosystem. He has been named amongst the Top 100 FinTech thought leaders/influencers in the world & Top 10 in Asia multiple times by reputed agencies, consulting firms as well as financial institutions. Amit has built MEDICI (formerly LTP) as a new-age, tech-enabled advisory/research firm, which is now considered the #1 global research & innovation platform for FinTech in the world.

Amit has been writing pioneering viewpoints on financial technology space that have been ahead of the curve since 2010. His data-driven predictions have helped the customers as well as the ecosystem. His past work experience includes a strong background in strategy & market analysis and advisory to clients (from big business houses to Fortune 500 firms) in payments, commerce, financial services & IT/technology. In the past, Amit had also founded a successful consulting & research practice called GrowthPraxis and has worked at Boston Analytics, Frost & Sullivan, and Daimler Chrysler in strategy & research.

Arjun Kharpal, CNBC

Arjun Kharpal is a technology correspondent for CNBC in London. He moved into the role after being a news assistant at the company for two years, and a reporter for a year following that.

Arjun’s heads up CNBC’s “Tech Transformers” special report, interviewing guests or offering analysis on “Squawk Box Europe” and “Street Signs”, as well as writing a plethora of stories online. He writes extensively on the technology industry covering the latest trends and topics all the way from the most innovative start-ups up to the biggest companies in the world including Apple and Google.

Arjun talks to the most important industry players including company chief executives, investors, and entrepreneurs.

Arjun has previously written for The Times, The Telegraph, The Guardian and The Mirror in London. He holds a BA in English Literature from the University of York and an MA in Newspaper Journalism from City University, London.

Austin Alexander, Kraken

Austin Alexander is a Senior Vice President at Kraken, one of the biggest digital asset exchanges in market volume worldwide. Austin first discovered Bitcoin in 2011 while working at the Mercatus Center, a free-market economic policy think tank.

Fascinated by the technology, Austin co-founded the Bitcoin Center NYC, an early bitcoin broker, event space, and educational resource. At the Bitcoin Center NYC Austin lead daily educational courses on Bitcoin from the center’s location 100 feet from the New York Stock Exchange. He also consulted high net-worth investors seeking to enter the digital economy.

Austin joined Kraken in 2014 as one of the industries first VIP account managers. Austin’s work at Kraken has been instrumental in the growth of the organization and the industry.

Brian Meenagh, Latham and Watkins

Chavan Bhogaita currently works as Managing Director & Head of Market Insights at First Abu Dhabi Bank. Earlier, he worked with the Alternative Investments and Fixed Income teams within NBAD’s Global Markets Division. He joined NBAD in 2009, specialising in GCC credit markets across all sectors. He has circa 25 years of professional experience in banking and finance, of which 18 years have been in credit research and analysis.

Since he joined NBAD (now FAB), Bhogaita has focused on the GCC fixed income markets and as such he spends much of his time talking to institutional investors around the world providing them with his analysis, insights and views on this market and the entities or issuers within it. Bhogaita is the overall project manager and MC for FAB’s flagship annual event, the Global Financial Markets Forum. Over the years at this gathering he has interviewed live on stage prominent individuals such as David Cameron, Nicholas Sarkozy, General Colin Powell, Tony Blair, Dr Mohammed El Erian, and Dr Larry Summers, among others.

Dan Doney, Securrency

Dan Doney is the CEO of Securrency, a combined FinTech or RegTech platform that enables the free trading of previously illiquid asset classes.

Doney is the former Chief Innovation Officer at the Defense Intelligence Agency and 2014 Fierce 15 awardee as a top government change agent. He has over 20 years of experience in emerging technology development and finance across government and private sectors. Dan is a software developer and innovator in artificial intelligence, cybersecurity, process automation, dynamic asset pricing and enterprise architecture.

Eyad Latif, Latham and Watkins

Latif is a senior associate in the Dubai office of Latham & Watkins, where he is a member of the Corporate Department and Mergers & Acquisitions and Emerging Companies and Venture Capital Practice Groups. His practice focuses primarily on representing emerging growth companies (public and private) and their funding sources including venture capital and private equity firms. He has represented numerous international and Middle East-based emerging growth companies and venture capital and private equity firms in transactions across a wide range of industries, including AI, BioTech, E-commerce, EdTech, CleanTech, FinTech and HealthTech.

Faissal Al-Juwaidi, SAMA

Faisal Al Juwaidi is Advisor to Deputy Governor for Banking Operations at SAMA. He began his career in Management Consulting in the United States. Faisal carries a wealth of consulting experience in the areas of management, finance, and strategy. At SAMA, Faisal develops strategic plans and focuses on key strategic priorities, such as, enhancing the digitisation of the financial sector, including customer driven virtual experiences.

Ghela Boskovitch, FemTechGlobal

Ghela Boskovitch is active in the FinTech industry, having spent the last 15 years focused on business development for core insurance and banking system solutions, the last half of which has centered on financial services pricing governance functionality. Boskovitch also founded FemTechGlobal to bridge the gender gap in FinTech and the financial services industry and was named one of Brummell Magazine’s 2016 "30 Inspirational Women Innovators," and included in Innovate Finance’s Women in FinTech Powerlist 2016 and 2017. She is a regular contributor to FinTech publications and discussions, specialising in dynamic pricing and customer centricity.

Henry Chang, HKMA

Henry Chang is a Senior Manager at the FinTech Facilitation Office of the Hong Kong Monetary Authority (HKMA) helping to facilitate the healthy development of the FinTech ecosystem in Hong Kong and to promote Hong Kong as a FinTech hub in Asia. He is responsible for the development of the Open API Framework for the Banking industry, the legal and data protection aspects of the whitepaper research on distributed ledger technology, and the first FinTech talent development programme. He also looks after international liaison and the non-bank interface of the FinTech Supervisory Chatroom of the HKMA.

Ibrahim Ajami, Mubadala Capital

Ajami is Head of Venture Capital at Mubadala Capital. He was previously the Executive Director of Mubadala Technology, responsible for overseeing the company’s interests in the advanced technology sector. He was also Chief Strategy Officer of GLOBALFOUNDRIES, the world’s second largest semiconductor foundry company from 2014 to 2016.

Prior to his current role, Ajami served as CEO of the Advanced Technology Investment Company, a Mubadala subsdiary. He oversaw the creation and strategic growth of GLOBALFOUNDRIES. Prior to that, he was an Associate Director at Mubadala’s Acquisitions unit executing M&A transactions around the world in various industries for Mubadala. Before joining Mubadala in 2006, Ajami worked for Occidental Petroleum and played a key role in the company’s successful expansion in the Middle East and North Africa region.

Jamal Rezzouk, VIASEMA

Rezzouk has a degree in Engineering and Applied Mathematics from the Ecole Centrale Paris and over 30 years of experience in the field of AI. He worked as an engineer for the French government space agency, CNES, for several years, before spending five years at ALCATEL ALSTHOM’s R&D department; which earned him numerous publications and three international patents in satellite image information extraction. He then joined the International group LEXISNEXIS to become their Director of Innovation for over 10 years, before joining forces with Philippe Carcopino to co-found Viasema in 2010. Rezzouk is considered as one of the leading minds in Knowledge Graph Engineering in the world today.

Jan Reinmüller, KPMG

Jan is the founder and head of the digital village of KPMG in Singapore. He is helping organisations transform through innovation, building new business models or optimising cost using emerging technologies. Jan brings international experience and knowledge of markets in U.S., Europe, India and ASEAN.

Leigh Flounders is the Senior Vice President of Group Digital Strategy & Engagement for Emirates NBD, and was the 2017 Finance Monthly Magazine New Zealand CEO Of The Year.

Having presented across New Zealand, Vietnam, Switzerland, Australia, China, Singapore, Hong Kong, USA and the UK, Flounders is a thought leader. He has worked extensively over the last two years with the Chinese tech giants Tencent, Ant Financial, Baidu, JDPay and a number of the main Chinese banks, watching them grow, dominate and innovate in the Financial Technology sector.

Leigh is a board member of the technology industry body NZTech and FinTech New Zealand, and has driven and exited two FinTech businesses securing global recognition from The Australia New Zealand Internet Awards (ANZIA) Tech Start Up of The Year, Austin Texas’ South By South West FinTech & Payment Category 1 Minute Pitch and the New Zealand Hi-Tech Awards Start Up Of The Year.

Lisa Nestor, Stellar

Lisa Nestor is a researcher and business strategist with a passion for financial empowerment. Prior to joining Stellar, Nestor was a business development volunteer with the Peace Corps (Mauritania ’07-’09), led operations and partnerships for a portfolio of research studies at the Centre for Microfinance (India) and most recently led product marketing and growth at Payoff.

Martin Tideström, ADGM

Martin Tideström is ADGM’s Director of Business Development. He is responsible for promoting Abu Dhabi as a business destination and attracting new firms, for providing growth support to ADGM’s client community, and for developing markets, products and services to enhance competitiveness of the financial centre and its business ecosystem.

Innovation and entrepreneurship are high on ADGM’s agenda. Tideström and his team have developed a range of support initiatives to facilitate set-up, growth and the financing lifecycle for start-ups and SMEs in the UAE, and they work closely with leading stakeholders across the region and internationally enhance and boost the sector.

Martin began his career as legal counsel with EY and Skandia, focused on venture capital. Prior to joining ADGM, Martin led business development for DIFC and QFC Authority.

Mai Gao, IDG Capital

Mei Gao joined IDG Capital as a partner in 2016 to focus on cross-border investments. Prior to joining IDG, she was the President of Fore Research & Management, a New York-based hedge fund with over $3 billion of peak AUM. Gao started her career in finance in 1998 with TD Securities where she managed a convertible arbitrage portfolio. In 2003 she left with her colleagues to start Fore Research & Management. She was the Head of Portfolio Management and has extensive investment experience in leveraged finance, equity-linked products and derivatives.

Munish Varma, SoftBank

Munish Varma is a Partner at SoftBank Investment Advisers, the manager of the SoftBank Vision Fund. Since joining, Varma has led several of the Fund’s investments in the FinTech sector, including in PolicyBazaar, India’s leading insurtech brand, and oversees its stake in PayTM – India’s largest digital payments platform.

He joined SoftBank from Deutsche Bank where he had held multiple roles across Global Markets and Wealth Management, rising to be the German bank’s Head of Global Markets business in India and part of the Global Markets Asia Pac ExCo.

Nick Cook, Financial Conduct Authority

Nick Cook is the Head of Regtech and Advanced Analytics at the Financial Conduct Authority (FCA). He leads the FCA’s RegTech activities, including the FCA’s TechSprint/hackathon events – the first events of their kind convened by a financial regulator. He is also responsible for implementing the FCA’s Data Strategy, and reforming the way the FCA collects, governs and uses data to inform its decision-making.

He is accountable for a range of data and analytics technology and change projects, and leads the FCA’s procurement of commercial market data. Nick is the FCA’s representative on the European Securities and Markets Authority’s (ESMA) Financial Innovation Standing Committee. Cook joined the Financial Services Authority (the FCA’s predecessor) in 2009, initially in its Enforcement and Market Oversight Division. Prior to joining the regulator, Cook qualified as a chartered accountant at KPMG Forensic.

Nikhil Kumar, iSPIRT

Nikhil Kumar is a full time fellow with iSPIRT Foundation, a non for profit think thank and has been focussed on building an ecosystem for the Unified Payments Interface. Recently, as a volunteer with NPCI, he led the product development of BHIM Payments App launched by PM Modi. Nikhil also works with Banks, Startups to help them leverage Digital Infrastructure built by the govt. like – Aadhaar eKYC, eSign, DigitalLocker, & UPI collectively known as the IndiaStack. Prior to this, Nikhil worked at strategic roles at Exotel, Intuit & Tally. He was also the CoFounder of Voyce, a B2B start-up which was acquired by Exotel in 2015.

Nour Al Dhaheri, Maqta Gateway

Noura Al Dhaheri is the CEO of Maqta Gateway, a subsidiary of Abu Dhabi Ports; providing digital services to facilitate trade. Maqta Gateway is the developer and operator of the first purpose-built and most innovative port community system in the UAE, titled Mamar. Designed in line with international standards, Mamar acts as a single window provider facilitating information flow between all port stakeholders and users.

She has helped usher in a seamless transition into a totally digitalised way of conducting trade, creating a bridge between data and the port’s business operations, while aligning with the Abu Dhabi 2030 economic vision and optimising port processes. One of the services developed by Maqta Gateway, for ports anchoring and departure, was recognised with the "Best Government Service Award" during the fifth edition of Abu Dhabi Government Excellence Award.

Her innovative vision, coupled with remarkable technical and managerial skills, have been instrumental to achieving successful implementation of the most advanced and high standard port community system. She was recognised with numerous prestigious awards for her outstanding contributions in the field of information technology, including the “Best Pipe Inspection Robot” Award which was presented to her by Schlumberger. She has also been published in the international and highly respected Journal of Manufacturing Systems, Computers & Industrial Engineering, Simulation Modelling Practice and Theory and Annals of Operations Research.

Another accolade has been a letter of recognition from Bill Gates who praised her innovative approach in designing a mobile learning device for which she and her team won the first prize in a regional competition – Imagine Cup 2007. In addition, Al Dhaheri was recognised with the Excellence in Leadership Award during the MAFNOOD 2016 Awards, in addition to Excellence in Best Technical Project. Her outstanding contribution to the Corporate Excellence Teams played an integral role in the awarding of Abu Dhabi Ports with several accolades from the Abu Dhabi Government Excellence Awards, including four categories, in addition to the Main Award for Outstanding Entity.

Al Dhaheri is also committed to social, environmental, technological and educational programmes. She is a founding member of the Emirates Digital Women Association and takes a leading role in supporting women in the digital and technical sectors, both at national and regional levels.

Oliver Rajic, Alpha Fintech

"I enjoyed attending University of Southern California and receiving my MBA at Kellogg, because it fostered challenging status quo. Having worked as the Global Payments Director at First Data, it helped formulate the most critical question: Why can we not have a solution ecosystem connecting everyone and eliminate the friction plaguing innovation and productivity," says Rajic. Having been awarded by the WPS to be the “World’s most influential payment professional,” Rajic focused on enabling innovation by becoming the industry central infrastructure fostering seamless access between the vendor both legacy and new innovative, and the bank in more urgent need than ever for agility, innovation and access.

Omen Mehrinfar, Plug and Play

Omeed Mehrinfar is a Regional Director of Plug and Play FinTech in Europe. He joined Plug and Play in August 2014 and, alongside Scott Robinson (VP and Global Head of FinTech), were tasked in launching a programme targeting the financial sector. Since the launch of the programme in January 2015, Mehrinfar has worked in five different accelerator classes with a total of 117 fintech startups, as well as a list of over 30 corporate partners; BNP Paribas, Deutsche Bank, Credit Suisse, to name a few.

Now based in Paris, Mehrinfar acts as the Programme Director of BNP Paribas' Plug and Play; a partnership between the two entities, targeted towards finding the best FinTech and insurtech startups that can innovate and disrupt different sectors of the financial market; while simultaneously evaluating investment opportunities in Paris and the larger Eurozone.

Pete Trainor, US AI

Pete Trainor has a very simple philosophy: Don’t do things better, do better things. He is an author, applied AI designer, technologist, accidental polymath, mental health campaigner and co-founder of US Ai. He talks all over the world on creative and social technologies, data, AI and the physiological and psychological effects on their audiences. His recently published, bestseller "Human Focused Digital" takes a philosophical look at technology and design, challenging us to look inwardly at the self when designing future technologies.

Over the last three years, Trainor has helped to pioneer an entirely new approach to AI focused services, one that looks at "self-evolving systems" and "minimum viable personality" to help solve societal and human issues. He regularly appears in UK national and international press as an analyst on emergent technologies, and tech markets. Trainot chairs the AI Think Tank for The British Interactive Media Association. He was recently voted by the industry, as one of the five most influential people in the British digital industry in Econsultancys 2017 industry report.

Richard Koh, Silent Eight

Richard Koh is the Head of Sales of Silent Eight, Singapore. Armed with over 12 years of strategic sales and business development experience in the risk and compliance industry, Richard is currently spearheading Silent Eight international business expansion plan for Asia Pacific and was instrumental in introducing the company’s suite of AI powered solutions for client screening and transaction monitoring across regional banking institutions for regulatory compliance purposes.

Prior to joining Silent Eight, Richard was the Senior Business Development Director of LexisNexis Risk Solution, managing South East Asia including Singapore, Cambodia, Thailand and Malaysia. His specific area of expertise include strategic planning, new market development and alliance partnership.

Previously, Richard was Account Director with Thomson Reuters , Governance Risk and Compliance division where he was in charge of the sales strategies growth in Singapore , Taiwan and Malaysia for the World Check risk database, Transaction Monitoring Solution and Enhanced Due diligence products.

Richard Teng, ADGM

Richard Teng joined Abu Dhabi Global Market in March 2015 as the CEO of the Financial Services Regulatory Authority. He is responsible for the development and administration of the financial services regulatory and supervisory framework of ADGM to promote a fair, open and transparent financial market. Mr Teng also oversees the strategic development of financial services offerings and growth of ADGM as an international financial centre. Under his stewardship, ADGM has become the first jurisdiction in the Middle East and Africa region to develop a Fintech Regulatory Laboratory Framework, becoming a hub to support Fintech stakeholders to develop, test and deploy their product and offerings in am controlled environment.

Teng is steering the development of a fintech ecosystem in Abu Dhabi that fosters financial innovations and supports the needs of fintech players. With more than two decades of regulatory leadership and capital markets experience in the financial industry, Teng joined ADGM from the Singapore Exchange (SGX), where he was the Chief Regulatory Officer. He also held several senior positions at SGX including Senior Vice President, Head of Issuer Regulation and Chief of Staff for Risk Management and Regulation, and Head of Regulation. Prior to SGX, Mr Teng served as the Director of Corporate Finance Division of the Monetary Authority of Singapore and was in charge of the financial centre development from MAS New York office between 2000 and 2002.

Robyn Brazzil, Start Abu Dhabi

Since 2014, Robyn Brazzil has led the design and development of the startAD program at NYU Abu Dhabi. startAD is an accelerator and entrepreneurship hub, anchored at NYU Abu Dhabi that supports early-stage startups to launch or grow in the UAE. Since the startAD program officially launched in 2016, Robyn has overseen five cycles of the startAD sprint accelerator program with 100 startups from 15 different countries.

She currently leads startAD’s corporate partnership strategy and growth initiatives while continuing to mentor startups and create new programs to build entrepreneurial capacity in the UAE. A former legal professional passionate about developing the UAE entrepreneurial ecosystem, she has designed and executed over 100 entrepreneurship programmes and events and serves as panelist and moderator for related activities. Prior to startAD, Brazzil worked as a trial attorney in New York City.

Rodrigue Afota, BlockTrust

Rodrigue Afota co-founded BlockTrust, incorporated in ADGM in late 2017, focusing on digital assets and institutional solutions. Prior to that, Afota spent 17 years as a banker in leading institutions in Europe, at Morgan Stanley, Natixis and, lately, at the National Bank of Abu Dhabi as Managing Director for Global Market Solutions. Rodrigue also has experience working with Private Equity and hedge funds.

Sagar Sarbhai, Ripple

Sagar Sarbhai is Head of Regulatory Relations for APAC and Middle East at Ripple, a payment technology company named one of the 50 Smartest Companies by MIT and the recipient of the World Economic Forum’s Technology Pioneer Award. Sarbhai manages Ripple’s relations with central banks and policy-makers across APAC and Middle East, focusing on payment innovation and virtual currency policy. Prior to Ripple, Sagar spent over nine years in the banking industry across multiple functions including technology, strategy, risk and government affairs. He was recognised as one of India’s top young business leaders by The Economic Times, India’s largest selling financial daily.

Suren Shetty, UAE Exchange

Surendra Shetty brings with him more than 24 years of experience in banking. He joined BRS Ventures & Holdings as Chief Technology Officer in December 2014 driving their technology initiatives. He was elevated as the Chief Information Officer of UAE Exchange from February 2016.

Prior to joining UAE Exchange, Surendra was with YES BANK as Senior President & Chief Information Officer. He spearheaded the Technology & Solutions Group. Surendra managed the Information Technology initiatives and was also responsible for further fortifying YES BANK’s technology edge. His responsibilities included driving innovation projects, and developing strategic planning guidelines in accordance with the Business Strategy of the Bank, leveraging and building upon Best in Class Technology as a key pillar and differentiator of YES BANK. His valuable industry insights have helped YES BANK to draft and design the IT Outsourcing – a first of its kind strategic partnership in India based on the novel concept of pay-per-use for IT Infrastructure.

Shetty was with Flexcel International as its Chief Technology Officer, responsible for implementation and services for its ASP clients. He has also worked as the Head-Implementation & Consulting for Cashtech Solutions, where he led multiple projects for Global Banking majors. Prior to that, Surendra was with HDFC Bank, heading their centralised data centre operations besides implementation of a wide spectrum of IT projects like Y2K compliances, system analysis and design for image based clearing automation, system performance audit, branch level implementation among others.

Susanne Chishti, FINTECH Circle

Susanne Chishti is the CEO of FINTECH Circle, Europe’s first Angel Network focused on fintech opportunities. She is also the founder of the FINTECH Circle Institute, the leading fintech learning platform offering classroom innovation workshops to C-level executives and online courses. Moreover, Chishti is the Co-Editor of the bestseller “The FINTECH Book” which has been translated into 10 languages and is sold across 107 countries, and The WealthTECH Book and The InsurTECH Book published in 2018.

Susanne is recognised in the European Digital Financial Services ‘Power 50’ 2015, an independent ranking of the most influential people in digital financial services in Europe. She has been selected as a “City Innovator – Inspirational Woman” in 2016. She has also been a FinTech TV Commentator on CNBC and is a guest lecturer on financial technology at the University of Cambridge.

After completing her MBA she started her career working for a FinTech company before the term “FinTech” was being invented in the Silicon Valley 20 years ago. She then worked more than 15 years’ across Deutsche Bank, Lloyds Banking Group, Morgan Stanley and Accenture in London and Hong Kong.

Tarek Fouad, Sharjah Entrepreneurship Centre

Tarek Ahmed Fouad is Venture Growth Manager at the Sharjah Entrepreneurship Center – Sheraa, spearheading Sheraa’s accelerator program to contribute to Sharjah’s vision in becoming the entrepreneurial hub of the Middle East. He brings in over eight years of experience in leading business entities and an extensive background in strategic marketing and lean business models.

Fouad founded Lean International in 2012, which was sold off to a private equity firm, and co-founded Wakil Technologies, a blockchain government services portal, earlier this year. He has also worked with the likes of TechWadi in Silicon Valley as UAE’s country manager. The young business entrepreneur has published numerous research papers in both engineering and marketing fields and was a motivational speaker in various events held by the Dubai government and TEDx.

Vasilis Tsolis, Cognitiv+

Vasilis Tsolis is the co-founder and CEO of Cognitiv+, a platform that extracts knowledge from legal data. Cognitiv+ extracts contractual obligations and risks, monitor relevant regulatory and legislative change and trigger alerts when action is required, saving thousands of hours from professionals and minimising unpleasant surprises.

With a dual background in law and engineering, Tsolis has worked under various roles in dispute resolution, contract, commercial and procurement management for various sectors including energy, infrastructure and IT for more than 12 years.Tsolis has worked for clients, contractors and consultancies to undertake various assignments for a wide spectrum of the outsourcing lifecycle and also on a strategic level.

Wai Lum, ADGM's Financial Services Regulatory Authority

Wai Lum joined the Financial Services Regulatory Authority (FSRA) of ADGM in June 2015. He leads the Capital Markets division responsible for authorisation and supervision of financial market infrastructures and capital market intermediaries. The division also regulates the offering of securities, collective investments schemes.

Wai also spearheads FSRA’s strategy and efforts to support the supervision of innovation in fintech and development of its ecosystem in ADGM. He has more than 10 years of supervisory experience. Prior to ADGM, Wai served as the director of the Capital Markets Intermediaries Division of the Monetary Authority of Singapore.

For the full agenda, click here.

Trending This Month

-

Feb 02, 2026